I hadn’t gotten away from Dallas in a good while and sometimes a “one day getaway” is all I need to recharge. Austin is usually my “go to” city of refuge but this time, I headed east. Hot Springs, Arkansas was the destination and I was determined to go even if for only a day. Road trips are what I use to clear my head. Driving the open road is so therapeutic. It gives me time to think which is sometimes difficult to do in the hustle and bustle of the city. With me being on a strict budget I figured the day AFTER Labor Day would be an ideal time for travel. Schools have reconvened and most people have taken their yearly vacations. This means low hotel occupancies which is always a bonus for the frugal traveler.

Embassy Suites, or any Hilton Affiliate Hotel for that matter, is where I often stay for the simple fact I’m a Hilton Honors Member. One day, these points will add up and eventually I’ll get a free night or two of hotel stay. I can’t wait for that day to come.

Traveling during non-peak times is ideal if you’re able to do so. Fuel prices are low so that means low prices on airline flights, gas, car rentals, hotel rooms, attractions, you name it. For all practical purposes, I’ll focus on hotel stays. What you MUST KNOW is you’ve got to ask for hotel upgrades. Some front desk agents will upgrade you because the’re feeling gracious but mostly do it because they want your continued patronage. For example, knowing local hotels in the city would not be at more than 50% occupancy (remember I’m in a tourist town the day AFTER Labor Day,) we knew we had leverage. Upon check in, my mother, (yes I traveled with Moms this time) was quoted a price of $160. I asked if that was the best rate they could give us. They knocked off $30. She’s a member of AARP which gave us an additional discount so let’s just say we got a double bed suite with a great view on the top floor for dirt cheap. Of course they hit us with the local and tourist tax. If you’ve stayed at an Embassy Suites Hotel (my favorite location is Downtown Chicago,) they have a complimentary happy hour every evening and complimentary breakfast every morning. You can’t beat that with a bat. The bed was so comfortable, I blew my budget of spending zero dollars on this trip, to purchasing two of the hotel’s down feather pillows from the HiltonToHome.com website. Although this purchase was a budget setback, after the good night’s rest I got, blowing the budget for the month will be well worth it.

Ask for upgrades. If a hotel doesn’t have free wifi and it’s off peak season, ask them to include it. Hotels can and will offer all sorts of concessions from upgraded rooms, free wifi, room service vouchers, keys to the mini bar (if that’s your thing) complimentary spa treatments, free conference room use (for business travelers) and the list goes on. As my mother always says, “Don’t tell yourself no. Let THEM tell you no.”

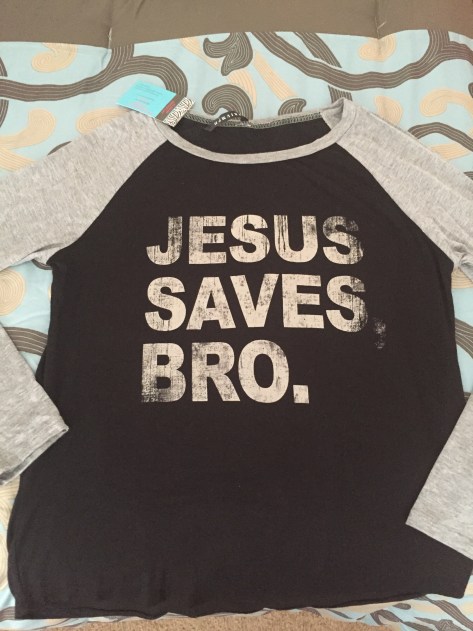

I could have easily stayed in the room and relaxed with a book, watching television, or enjoying the mountainous view, but my mom and I hit the Hot Springs streets. As we strolled down Central Ave, we visited several quaint shops and boutiques, one in particular was Snazzies Inc (find them on Facebook) where I fell in love with this baseball shirt:

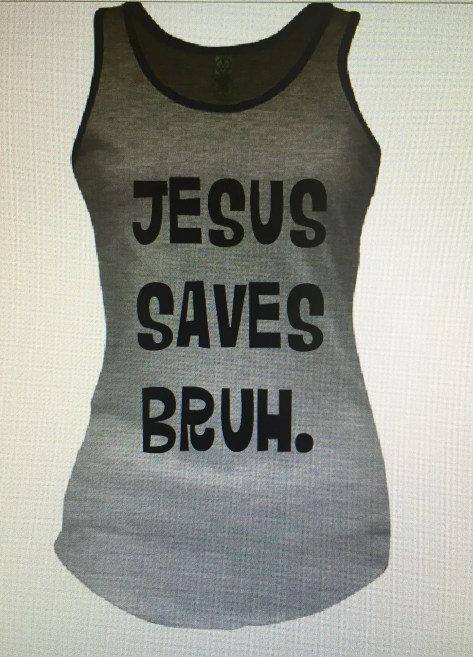

Now here’s where the “frugal me” comes in. I just HAD to have this shirt. Non-essential items was NOT in the budget but I purchased it anyway. It hit me after I got back to the room: I could have designed this same shirt for the same amount of money. Just on general principle, when I got back to town today, I went on a popular “design your own” t-shirt website and came up with this:

I like my version better…. It should arrive early next week.

That goes to show impulse purchases are a “No No” when budgeting. I definitely didn’t think that one through. Oh well. I still LOVE the shirts.

The downside of the trip: The bathhouses were closed. We didn’t want to get in the water, just put our feet in. Also because of the off-peak season, a lot of the tours weren’t available to us. Had it been a weekend, they would have. It didn’t matter. That meant less money to spend and I didn’t care. I was enjoying myself.

The upside of the trip: I had one of the best cupcakes (an Ooey Gooey Buttercream Cupcake) from Fat Bottomed Girls Cupcake Shoppe as featured on the Food Network.

To work off the cupcake, me and my 69 year old mother hiked some 2mi… Uphill.

The view was beautiful. And guess what? It didn’t cost us a thing. I’m glad I packed an extra pair of sneakers. She was such a trooper, I rewarded her by dropping her off at the casino and gave her my $10 voucher the hotel gave us. Now she has $20 to play the penny slots. What is it about old ladies and slot machines? Snickering, I’ll never understand. I won’t even begin to try.

After feasting on pancakes, bacon, potatoes, omlettes, various pastries and fresh fruit this morning, it was time to head out. We couldn’t leave without taking with us what Hot Springs is best known for… ITS NATURAL SPRING WATER. We purchased a couple of two gallon jugs and proceeded to the local water dispenser. Poor Moms. Her spout was defective, the splatter leaving her shirt wet. She mumbled under her breath as she moved to the next spout. The water flowed much smoothly. I filled my jug, gave Central Street one last glance and smiled. We did a lot in 24 hours and I wasn’t tired. Window shopping didn’t cost a thing, watching the sun play peek-a-boo with the clouds while we hiked didn’t cost a thing and most importantly, the time I spent with my mom didn’t cost a thing (with the exception of a slight headache or two.) But at that very moment, the feeling of calm and inner peace I had within, my friends, certainly didn’t cost a thing.

~The Financial Hack ©2015